In today's fast-paced financial markets, many traders are finding it beneficial to manage multiple trading accounts with a prop firm. Proprietary trading firms, commonly known as prop firms, offer an attractive solution for traders looking to expand their reach and diversify their portfolios.

Understanding Proprietary Trading Firms

Proprietary trading firms, particularly the top-rated prop trading firms, are entities that provide their traders with the necessary capital, resources, and technology to trade financial instruments on their behalf. These firms often operate as partnerships or corporations and make profits from successful trading activities. Traders within prop firms have access to advanced trading platforms, research tools, and support systems that can enhance their trading performance.

Ad

The Role of Prop Firms in Trading

Prop firms play a crucial role in the trading ecosystem. They act as intermediaries between traders and the financial markets, providing traders with the platform to execute their strategies. Prop firms also take on the risk associated with the traders' activities, allowing individual traders to trade with greater capital and potential returns.

Benefits of Trading with a Prop Firm

Trading with a prop firm offers several benefits for traders. Firstly, prop firms provide traders with access to significant capital resources that may not be available to individual traders. This increased capital allows traders to diversify their positions and potentially maximize their gains.

Secondly, prop firms often have access to advanced trading technology and research tools. Traders can leverage these resources to gain valuable insights into market trends and make more informed trading decisions.

Furthermore, prop firms provide a supportive trading environment. Traders can benefit from the expertise and guidance of experienced professionals, enhancing their trading skills and knowledge.

Setting Up Multiple Trading Accounts

Once you have decided to manage multiple trading accounts, it is essential to follow the necessary steps to set up these accounts. Proper account setup ensures ease of management and allows traders to take full advantage of the benefits offered by prop firms.

Steps to Open Multiple Accounts

The first step in opening multiple trading accounts is to research and select the prop firms that align with your trading goals and preferences. Consider factors such as capital requirements, trading platforms, available markets, and risk management protocols.

Things to Consider When Opening Multiple Accounts

While opening multiple trading accounts can be beneficial, there are some key considerations to keep in mind. Firstly, ensure that you have a disciplined approach to managing your accounts. Set clear risk parameters and stick to them to prevent losses from escalating across all accounts.

Secondly, carefully analyze the costs associated with managing multiple accounts. Prop firms may have different fee structures, and these costs can impact your overall profitability. Evaluate the fee structure and assess whether it aligns with your trading strategy.

Lastly, keep in mind the effort required to manage multiple accounts effectively. While the benefits are evident, managing multiple accounts requires consistent attention and monitoring. Plan your time and resources efficiently to avoid spreading yourself too thin.

Effective Management of Multiple Trading Accounts

Once you have set up your multiple trading accounts, it is crucial to adopt effective management strategies to ensure optimal performance and minimize risks.

Strategies for Balancing Multiple Accounts

One key strategy for balancing multiple accounts is to diversify your positions across various markets and instruments. This diversification helps spread risks and enhances the potential for gains.

Ad

Another important consideration is to regularly review and assess the performance of each account. Identify accounts that may be underperforming and take necessary actions to optimize their performance. This could involve adjusting trading strategies, reallocating capital, or seeking additional guidance from prop firm experts.

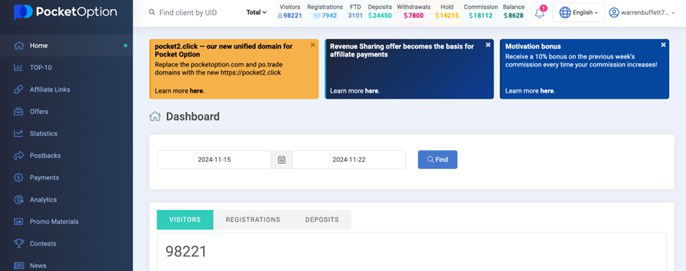

Tools for Managing Multiple Trading Accounts

There are several tools available to assist traders in managing multiple trading accounts effectively. Trading journal software can help track and analyze performance across accounts, allowing for intelligent decision-making. Additionally, portfolio management software can provide a comprehensive overview of all accounts, facilitating easier monitoring and risk assessment.

Furthermore, prop firms often offer robust risk management tools. These tools can help traders set stop-loss orders, analyze historical market data, and stay updated with real-time market news. Utilizing these tools can contribute to enhanced risk management across multiple accounts.

Risk Management Across Multiple Accounts

Trading with multiple accounts inherently involves increased risk due to the larger exposure to the markets. It is crucial for traders to implement effective risk management techniques to protect their capital.

Understanding the Risks of Multiple Trading Accounts

One of the primary risks associated with managing multiple accounts is the potential for losses to accumulate rapidly across all accounts. If a particular trading strategy or market sector experiences adverse movements, the impact may be magnified across multiple accounts.

Another risk to consider is the increased complexity of monitoring and managing multiple accounts simultaneously. Traders must be diligent in their monitoring efforts to identify any irregularities or deviations from their desired risk parameters.

Techniques for Mitigating Risks in Multiple Accounts

To mitigate risks, it is essential to establish clear risk management protocols across all trading accounts. Set appropriate stop-loss orders, adhere to position sizing limits, and regularly review and adjust risk parameters based on market conditions.

Diversification is also a powerful risk management technique. Allocate your capital across various markets, asset classes, and trading strategies to reduce the impact of adverse movements in a single account or sector.

Maximizing Profits from Multiple Trading Accounts

The ultimate goal of managing multiple trading accounts is to maximize profits. To achieve this, traders should employ strategies specifically tailored to multiple account management.

Tips for Profitable Trading with Multiple Accounts

One key tip for profitable trading with multiple accounts is to maintain discipline and stick to your trading plan. Emotional decision-making can lead to costly mistakes. Create a solid trading plan and execute it consistently across all accounts.

Ad

Another tip is to analyze the performance of each account individually as well as collectively. Identify patterns, trends, and areas for improvement. Leverage the resources and expertise offered by prop firms to enhance your trading strategies and maximize potential profits.

How to Leverage Multiple Accounts for Greater Returns

Leveraging multiple accounts for greater returns requires a systematic approach. Continuously evaluate the impact of each trade on your overall portfolio and capital allocation. Adjust your trading strategies accordingly to optimize returns.

Take advantage of the flexibility provided by multiple accounts. Explore different markets, experiment with various trading strategies, and adapt your approach based on market conditions. Embrace the learning opportunities and potential for increased profits that come with managing multiple accounts.

— Comentários0

Seja o primeiro a comentar